What drives us ...

... is the idea of a sustainable society that sees economy as a "we-conomy". A form of economic activity in which the "we" is central. Sustainable, in harmony with nature and all the living beings connected with it. Without harmony, there is no sustainability.

A new era of ensuring the survival of our planet also needs a new kind of "market". One in which social and ecological values are increasingly being traded.

Paradigm change in the financial sector is very near and dear to our hearts: Impact investing has the potential to make it happen!

Out of deep conviction, the topics "sustainable investing" and "responsible investments" are increasingly coming into our focus.

We therefore create a field in which conscious intelligence can form on the topics of sustainability, social, green and impact investing. Caring for our planet and the need to finance the great challenges of our society are not mutually exclusive - quite the contrary. A society nurturing economy needs funding. Keywords: energy transition, social infrastructure, education.

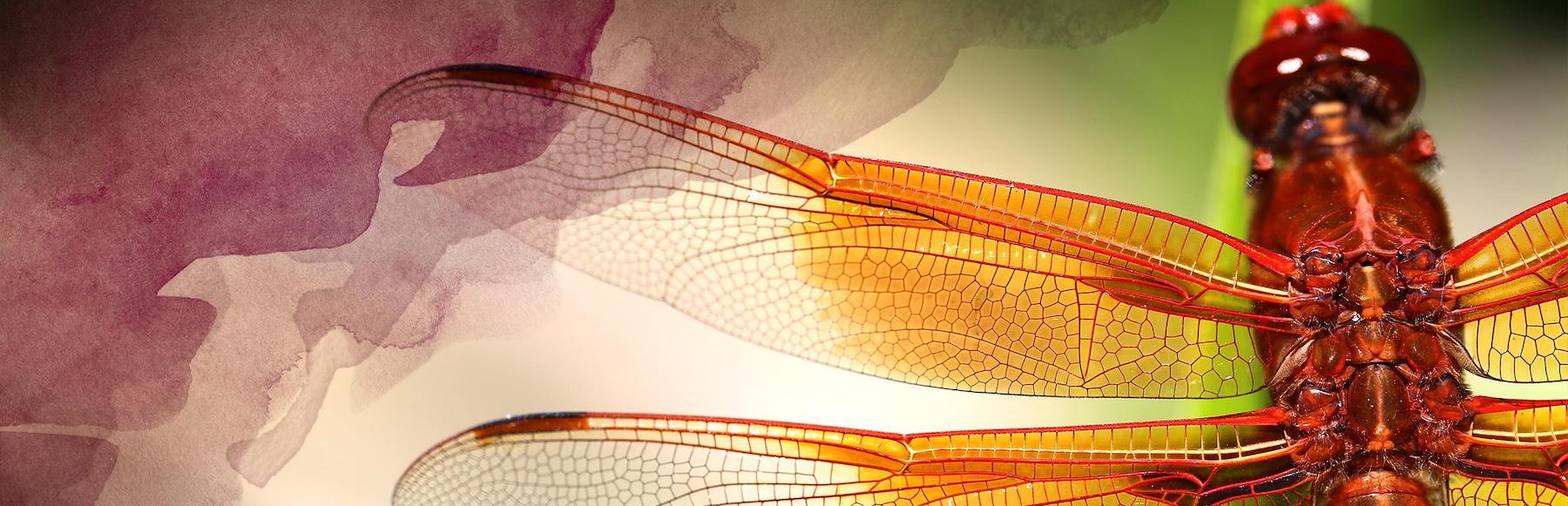

I personally love to create meaning with my being - for the benefit of all living beings on this wonderful planet! Out of this desire and the feeling of having a "job to do" in the financial sector, I founded my company. The Dragonfly inspired me. She embodies incredible powers of transformation - leaving behind the predatory larva living beneath the water surface, she rises to emerge into the light and mutate into the Dragonfly. She is a true flying artist and radiates with incredible lightness. She does not stand against the storm but uses it to fly with it.

What symbolism could be a better fit for this period of change? We are facing incredible challenges and a turning point. We are gradually recognizing that the time is ripe for a transformation into a sustainable society. My vision is to bridge separate worlds in order to help shape this kind of new society.